Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Study on Cashless Payments in Retail Businesses in Rural Areas of Kurnool District of Andhra Pradesh

Authors: Dr. Kamma Ramanjaneyulu, Ravi Rachapudi

DOI Link: https://doi.org/10.22214/ijraset.2024.63560

Certificate: View Certificate

Abstract

In India post demonetization, cashless transactions have emerged as a significant trend in the Indian economy. They are touted for their convenience, simplicity, and enhanced safety compared to cash transactions. This shift is notably affecting the spending habits of rural residents in Kurnool district, Andhra Pradesh. The purpose of this article is to explore rural attitudes towards cashless transactions. A study conducted among 100 respondents revealed that 65% of rural residents engage in cashless transactions, particularly those with higher education levels. However, 35% of respondents still do not use cashless methods. These findings underscore the need for education and awareness programs aimed at rural communities to promote cashless transactions. Such initiatives could play a crucial role in fostering economic development and transforming spending patterns in these areas.

Introduction

I. INTRODUCTION

India is gradually moving from a cash-reliant economy to one that increasingly relies on digital transactions. Digital transactions can be traced, ensuring easier taxation and reducing the circulation of black money. The entire nation is embracing modernized monetary transactions, with electronic payment services gaining significant momentum. Even street vendors now accept electronic payments, accelerating the adoption of cashless transactions among the populace.

Cashless transactions offer numerous advantages and contribute to economic development by facilitating the electronic purchase and payment of goods and services. Each transaction is recorded, enhancing transparency and compliance with regulations. Various cashless payment options such as online transfers (NEFT or RTGS), UPI apps, cheques, demand drafts, mobile banking, and online banking are becoming increasingly accessible. Given these developments, this study aims to explore the perceptions of rural populations regarding current cashless transactions.

II. OBJECTIVES OF THE STUDY

- To comprehend the significance of cashless transactions.

- To outline the various methods employed in cashless transactions.

- To analyze the perceptions of rural populations regarding cashless transactions.

III. RESEARCH METHODOLOGY

A. Sampling

The researchers used the simple random technique to draw samples from the rural area of Kurnool district of Andhra Pradesh. The sample size was 100.

B. Tools used for the study

For this study, researchers gathered both primary and secondary data. Primary data was collected through a structured questionnaire, utilizing scales such as the 3-point and 5-point Likert scale for specific questions and the Secondary data was sourced from the internet, books, and magazines. Analysis and interpretation employed simple statistical tools such as percentages, and key findings were summarized in tables. Hypothesis testing was conducted using the Chi-square test.

C. Hypothesis

- Null Hypothesis (H0): There is no significant relationship between education and cashless transactions in rural areas.

- Alternative Hypothesis (H1): There is a significant relationship between education and cashless transactions in rural areas.

IV. SIGNIFICANCE OF THE STUDY

The central government's focus on promoting cashless transactions aims to diminish corruption and further the Digital India initiative. The response from the population indicates strong support for this government initiative, suggesting its potential success. Increased transparency in the economy through e-commerce transactions and digital payment gateways is expected to boost GDP and enhance the country's credibility, attracting more investments. Researchers thus sought to study cashless transactions in rural areas of Kurnool as part of these transformative efforts.

V. LITERATURE REVIEW

Das and Agarwal (2016) examined India's cashless payment system and suggested that it poses a financial burden for the government. They advocate for transitioning towards a cashless payment system that reduces transaction tracking costs, manages foreign exchange more efficiently, and promotes financial inclusion. Additionally, such a system could integrate the shadow economy into the formal economy, fostering broader economic participation.

According to Kumar Piyush (2018), cashless payments help decrease currency management costs, enable better transaction tracking and recording, and promote improved buyer behavior towards cashless transactions.

Deepika Kumari (2023) study on methods, applications, and challenges of cashless transactions, Deepika Kumari concluded that the Indian government aims to increase awareness of cashless transactions through the implementation of demonetization.

VI. STUDY FINDINGS

A. Significance Of Cashless Transactions

Cashless transactions are gaining significant traction in today's world, particularly in rural areas where adoption is steadily increasing. The Government of India advocates for cashless transactions, citing benefits such as heightened employment rates and decreased instances of cash-related theft, as carrying physical cash poses risks. Moreover, the policy aims to curb corruption associated with cash and attract foreign investments, thus modernizing payment systems and reducing banking costs.

B. Different methods used in cashless Transactions

Various methods facilitate cashless transactions, categorized by the RBI under prepaid payment instruments. These include debit and credit cards, checks, mobile banking, demand drafts, e-wallets, and online transfers. These methods offer transparency as each transaction is traceable, fostering trust. Urban areas have embraced these methods more readily than rural regions, where the adoption remains a challenge. According to field surveys, debit cards are prevalent among rural residents, with limited use of other cashless options..

C. Rural residents' perspectives on cashless transactions

The perception of cashless transactions among rural residents reveals varying levels of acceptance and utilization. While some rural communities are gradually adopting cashless methods, such as debit cards, others continue to face challenges in embracing these alternatives. This disparity underscores the ongoing effort needed to enhance awareness and infrastructure to facilitate broader adoption of cashless payment options in rural areas.

Table 1: Awareness of cashless Transaction

|

Awareness of Cashless Transactions |

Number of Participants |

Percentage |

|

Yes |

64 |

64% |

|

No |

36 |

36% |

|

Total |

100 |

100% |

Source: Primary Data

The above table illustrates the level of awareness among respondents regarding cashless transactions. Out of a total of 100 respondents surveyed:

64 respondents (64%) are aware of cashless transactions. This indicates that a significant majority of the surveyed population is familiar with digital payment methods and their usage.

36 respondents (36%) are not aware of cashless transactions. This signifies that a notable portion of the respondents have limited or no knowledge about digital payment systems.

Overall, the data highlights that while a majority of individuals are informed about cashless transactions, there remains a significant opportunity to enhance awareness and adoption, especially among those who are currently unfamiliar with these method.

VII. TESTING OF HYPOTHESIS

Hypothesis testing is a statistical method used to make inferences about a population based on sample data. It involves formulating a hypothesis about the population parameter, collecting and analyzing data, and then making a decision about whether the data provides enough evidence to either reject or fail to reject the null hypothesis in favor of an alternative hypothesis. This process helps researchers and analysts draw conclusions and make decisions based on the observed data and its statistical significance.

Table 2: Education's Influence on Cashless Transactions

|

Respondent Categories |

Academic Qualification |

|

|||||

|

Illiterates |

Elementary / Secondary |

Pre-university |

Undergraduate |

Others |

|||

|

Card-based Cashless Transactions |

0 |

11 |

5 |

24 |

9 |

51 |

|

|

Cash Transaction |

3 |

21 |

8 |

7 |

8 |

49 |

|

|

Total |

3 |

32 |

13 |

31 |

17 |

100 |

|

Source: primary data

The above table indicates that among the respondents surveyed those with a Degree education level show the highest preference for cashless transactions, with 24 out of 31 preferring this method. Primary/High School-educated respondents also show a significant preference for cashless transactions, with 11 out of 32 opting for them and Illiterate respondents and those with PUC education have very low preferences for cashless transactions, with none among Illiterates and only a few among PUC-educated respondents favoring cashless methods.

Overall, while cashless transactions are preferred by a substantial number of respondents with higher education levels, there is variability across different educational categories in terms of adoption of cashless payment methods.

HYPOTHESIS:

The Null Hypothesis (HO) is that rural residents do not prefer cashless transactions based on their level of education.

Alternative Hypothesis (H1): Rural residents prefer cashless transactions based on their education level.

Table 3: Chi – Square Analysis

|

X2 Value |

Table value |

Significance |

|

16.8 |

7.82 |

Highly Significance |

Source: Primary Data

Based on the Chi-square test, we reject the null hypothesis that there is no relationship between education and cashless transactions, indicating that there is indeed a significant relationship. Therefore, we accept the alternative hypothesis that education and cashless transactions are related. This suggests that a higher proportion of educated individuals in rural areas engage in cashless transactions, while fewer illiterate or poorly educated rural individuals use cashless methods.

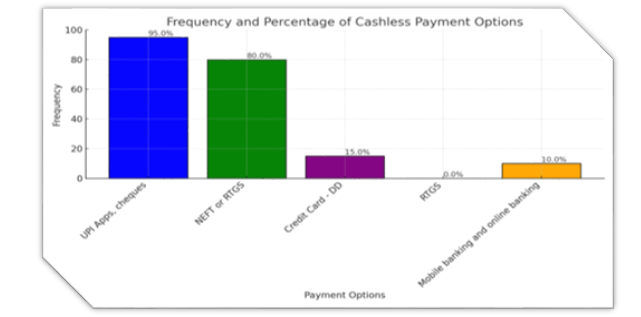

Table 4: Methods of Cashless Payments Used By Rural Residents Is Provided

|

Cashless Payment Options |

Amount of frequency |

Total |

Percentage |

|

UPI Apps, cheques |

95 |

100 |

95.00 |

|

NEFT or RTGS |

80 |

100 |

80.00 |

|

Credit Card - DD |

15 |

100 |

15.00 |

|

RTGS |

0 |

100 |

0.00 |

|

Mobile banking and online banking |

10 |

100 |

10.00 |

Source: Primary Data

Based on the above table indicate that available for cashless payments are the UPI Apps and Cheques: This is the most frequently used method, with 95 out of 100 respondents using it. This accounts for 95% of the total respondents and followed by the NEFT or RTGS: 80 out of 100 respondents use this method, representing 80% of the total respondents, Credit Card - DD: 15 out of 100 respondents use this method, making up 15% of the total respondents, RTGS: According to the data, none of the respondents use RTGS. Therefore, it represents 0% of the total respondents and Mobile Banking and Online Banking: 10 out of 100 respondents use this method, accounting for 10% of the total respondents.

The data illustrates the distribution and popularity of various cashless payment options among the respondents are the UPI Apps payments and Cheques emerge as the most preferred method, used by a significant majority of respondents, highlighting its widespread adoption and convenience, the NEFT or RTGS also show substantial usage, indicating their role in larger transactions or regular payments, Credit Card - DD and Mobile Banking and Online Banking have lower adoption rates compared to UPI and NEFT/RTGS, suggesting they are used less frequently among the surveyed population and The absence of respondents using RTGS may indicate either a lack of familiarity or preference for other methods among the surveyed group.

Overall, the data underscores the dominance of UPI Apps and the significant role of NEFT/RTGS in the cashless payment landscape, with credit cards, mobile banking, and online banking playing supplementary roles depending on specific use cases and preferences

Table 5: Payment Method Usage Frequency

|

Frequency of Electronic Transactions |

Number of Participants |

Percentage |

|

Frequent |

25 |

25% |

|

Occasional |

64 |

64% |

|

Never |

11 |

11% |

|

Total |

100 |

100% |

Source: Primary Data

This table shows the distribution of respondents based on how frequently they engage in cashless transactions are Most of the time: 25 respondents, representing 25% of the total, use cashless transactions as their primary mode of payment and followed by the Some time: 64 respondents, accounting for 64% of the total, use cashless transactions occasionally but not exclusively and Never: 11 respondents, making up 11% of the total, do not use cashless transactions at all.

The overall data, this breakdown indicates that a significant majority of respondents use cashless transactions at least occasionally, with a notable portion using them as their primary method of payment.

Table 6: Impact of Cashless Transactions on Economic Development

|

Economic Progress |

Number of Participants |

Percentage |

|

If Yes |

90 |

90% |

|

If No |

10 |

10% |

|

Total |

100 |

100% |

Source: Primary Data

Above table reflects that, all the respondents' views on economic development wise comprising 90% of the total, believe that economic development is occurring or has occurred And followed by the No: 10 respondents, representing 10% of the total, do not believe that economic development is occurring or has occurred.

The overwhelming majority of respondents perceive economic development positively, indicating a strong belief that economic progress is either ongoing or has been achieved in their context. The minority who responded negatively suggests there are differing perspectives on the state of economic development among the surveyed population

Table 7: Significance of Cashless Transactions in Curbing Corruption

|

Economic Progress |

Number of Participants |

Percentage |

|

If Yes |

87 |

87% |

|

If No |

23 |

23% |

|

Total |

100 |

100% |

Source: Primary Data

This table presents respondents' perceptions regarding economic development: Yes: 87 respondents, accounting for 87% of the total, believe that economic development is occurring or has occurred. No: 23 respondents, making up 23% of the total, do not believe that economic development is occurring or has occurred.

The majority (87%) of respondents hold a positive view on economic development, indicating that they perceive some level of progress or improvement in the economic situation. However, a notable minority (23%) expresses skepticism or a contrary belief regarding economic development in their context. This diversity in opinions suggests varying interpretations of economic conditions among the surveyed population.

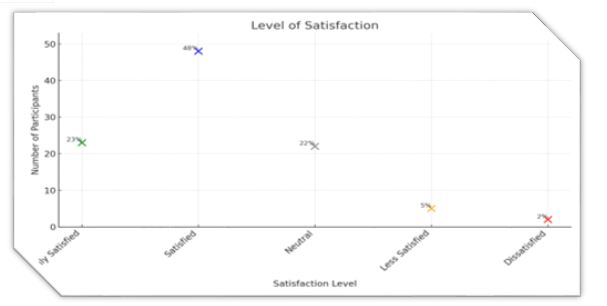

Table 8: Satisfaction Levels of Respondents with Cashless Transactions

|

Level of Satisfaction |

Number of Participants |

Percentage |

|

Highly Satisfied |

23 |

23% |

|

Satisfied |

48 |

48% |

|

Neutral |

22 |

22% |

|

Less Satisfied |

5 |

5% |

|

Dissatisfied |

2 |

2% |

|

Total |

100 |

100% |

Source: Primary Data

Above table indicate that more Satisfied (23 respondents, 23%): These respondents are highly content with their experience or service. They likely perceive a high level of fulfillment and positivity and followed by the Satisfied (48 respondents, 48%): This group shows general satisfaction but might have some minor concerns or areas for improvement. Overall, they are pleased with their experience, Neutral (22 respondents, 22%): These respondents neither express satisfaction nor dissatisfaction. They might be indifferent or have mixed feelings about their experience, Less Satisfied (5 respondents, 5%): These individuals are somewhat dissatisfied with their experience. They may have encountered significant issues or found aspects lacking and dissatisfied (2 respondents, 2%): This group is clearly unhappy with their experience or service. They likely encountered substantial problems or had very negative perceptions.

This table provides a breakdown of respondents' satisfaction levels, offering insights into how they perceive their experiences or services provided.

Table 9: Respondents' Overall Rating of Cashless Transactions

|

Rating |

Number of Participants |

Percentage |

|

Excellent |

21 |

21% |

|

Good |

75 |

75% |

|

Poor |

4 |

4% |

|

Total |

100 |

100% |

Source: Primary Data

The above table revels that, Excellent (21 respondents, 21%): These respondents rated their experience or service exceptionally well. They likely found it to be outstanding and exceeding their expectations and followed by the Good (75 respondents, 75%): This majority indicates a strong level of satisfaction. These respondents generally had a positive experience or service, though there may be some areas for improvement, Poor (4 respondents, 4%): These individuals rated their experience or service poorly. They likely encountered significant issues or found the experience unsatisfactory.

This table provides a clear overview of how respondents rated their experience or service, highlighting the distribution across different satisfaction levels.

VIII. SUGGESTIONS

The following points are listed initiatives to enhance digital payment adoption in rural areas:

- Enhance Internet Connectivity: Collaborate with telecom providers to improve internet coverage and reliability in rural areas.

- Deploy Payment Terminals: Equip retailers with POS terminals and mobile payment devices that support various digital payment methods.

- Digital Literacy Programs: Conduct workshops and training sessions to educate retailers and consumers on using digital payment platforms effectively.

- Personalized Assistance: Offer one-on-one support to help individuals set up and utilize digital wallets and banking apps.

- Incentivize Digital Payments: Partner with banks to offer incentives such as discounts, cash back, and rewards for adopting digital payments.

- Localized Campaigns: Use local languages and culturally relevant messaging to promote the advantages of cashless transactions.

- Showcase Success Stories: Share stories of rural businesses that have successfully embraced cashless payments to inspire others.

- User-Friendly Platforms: Ensure digital payment platforms are simple to use and prioritize security.

- Fraud Awareness: Educate users about identifying and avoiding fraud and scams associated with digital transactions.

- Feedback Mechanism: Establish a system for receiving and acting upon user feedback to enhance the digital payment experience.

- Offline Solutions: Provide options for offline transactions in areas with unreliable internet connectivity.

- These initiatives aim to foster a favorable environment for digital payment adoption in rural communities, addressing both infrastructure challenges and user education needs effectively.

Conclusion

In a large country like India, where a significant portion of the population lives below the poverty line, the challenges of transitioning to a cashless economy are inevitable but necessitate proactive steps. Recent shifts in public perception towards digital transactions reflect growing recognition of their safety, ease, convenience, and transparency, with the added benefit of combating black money and counterfeit currency. The Cash or Cashless India campaign, spearheaded by the Indian government, aims to transform the economy from cash-centric to digital, thereby ushering in substantial economic reforms. However, it\'s observed that in rural areas, varying levels of education influence people\'s awareness and adoption of cashless transactions. Highly educated individuals tend to embrace digital payments more frequently. In contrast, illiterate individuals face barriers such as technological complexity, lack of information, disinterest, age-related challenges, inconvenience, and misconceptions. To achieve widespread adoption, it\'s crucial that all segments of society integrate digital transactions into their daily lives. This holistic approach is essential for the comprehensive development of our nation.

References

[1] Seema Singh. (2017). \"Cashless transactions in rural India: A study of rural areas in Gurugram city.\" International Journal of Research. [2] Gustavo A. Del Angel. (2018). \"Cashless payment and the persistence of cash.\" Hoover Institution Economic Working Papers. [3] Nirbhay Mahor. (2023). \"A study of customer perceptions regarding the risks of cash and cashless transactions.\" Kaav International Journal of Economies, Commerce & Business Management. [4] Sheethal Thomas & G. Krishnamurthy. (2017). \"Cashless Rural Economy - A Dream or Reality.\" Jharkhand Journal of Development & Management Studies. [5] Pranjali A. Shendge, Bhushan G. Shelar, Smitaraja S. Kapase. (2017). \"Impact and Importance of Cashless Transactions in India.\" International Journal of Current Trends in Engineering & Research. [6] www.shodhganga.com

Copyright

Copyright © 2024 Dr. Kamma Ramanjaneyulu, Ravi Rachapudi. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63560

Publish Date : 2024-07-05

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online